Alto Investments’ ability to source and purchase quality properties at a discount to market value allows us to meet our client expectations. There is an old adage in real estate “THE MONEY IS IN THE BUY AND THE REST TAKES CARE OF ITSELF.” Based on this philosophy and an expert understanding of the foreclosure process, we currently employ multiple strategies to identify and capture the most and the best opportunities. Properties do not fall through our fingertips. Our primary sources are as follows:

· Courthouse Auctions · Tax Auctions · REO · Portfolio Sales · Short‐Sales · Resellers ·

· Public/Private Partnerships · Direct lender/Bank Relationship

COURTHOUSE AUCTION:

Alto Investments is the leading purchaser of foreclosed properties at the courthouse steps. There is a tremendous amount of research necessary to compete effectively, but this source provides a very efficient and transparent way to obtain property. Due to the high barriers of entry, high level of skill and knowledge required, coupled with the high levels of risk for unsophisticated investors, there are a small number of expert investors competing for these properties. Since we have intimate financial knowledge of our competition within this marketplace, our contention is that we will continue to meet Investors’ ROI expectations.

REO:

Alto Investments has developed a sterling reputation with REO Brokers, by placing competitive offers, and by “doing what we say we will do”. On a monthly basis we research and analyze hundreds of REO opportunities and place dozens of offers. The sale of REO property in an open market activity, anyone with a checking account can place an offer. Consequently what the competition lacks in skill it makes up for in sheer numbers. Relationship building and “performance” is vital to success in this arena. Based on our competitive advantages we feel we will be able to reach our objective of monopolizing this marketplace.

SHORT SALE:

Alto Investments believes for the next couple of years Short Sales will see the largest growth of closed sales compared with the other foreclosure markets. Our contention is based upon the perception that banks have finally begun to understand that by punishing their defaulting borrowers by acting uncooperative in the Short Sale Process they are actually diminishing the value of their assets.

STRATEGIC PARTNERSHIPS:

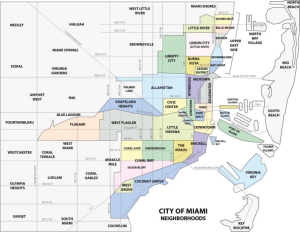

Description: in order to capitalize on the opportunities provided for by the U.S. Department of Housing and Urban Development (HUD), through the Neighborhood Stabilization Program (NSP), Alto Investments is partnering with Neighborhood Housing Services of South Florida (NHS), a 501‐c3 non‐profit, and the largest Community Housing Development Organization (CHDO) in Florida, to purchase and rehabilitate foreclosed housing . Through our attorney, we are in the process of establishing Public/Private Partnerships with several municipalities in South Florida. Under these Partnerships, Alto Investments would act as the Developer, NHS would be the Non‐Profit, and Municipalities would qualify us to purchase properties directly from Fannie Mae (FNMA), in bulk (minimum 25) at significant discounts, before these properties are made available to other purchasers. Additionally, as per Fannie Mae guidelines, we are allowed to “kick‐out” any asset from the bulk sale that doesn’t meet our needs. Essentially we will be allowed to “cherry‐pick” their portfolio, as long as it meets the 25 property minimum. Benefits: currently the forecasted results of this acquisition method are unquantifiable, but our strategic purpose of this Public/Private Partnership, is to eventually supplant Alto Investments’ REO Acquisition methods on MLS. The primary benefits of this Acquisition method are: 1) higher quality properties, 2) lower purchase price, 3) lower acquisition costs, 4) easier acquisition, and 5) non‐existent competition.